by yeseric | May 25, 2018

Happy 230th birthday to the State of South Carolina! The Palmetto State became a state on May 23, 1788. There are countless legacies in the generations of South Carolinians who have come and gone. What will be your financial legacy? Say “I Love You” to...

by yeseric | May 23, 2018

Imagine you find yourself with $30,000 in unsecured debt (credit cards, student loans, and personal loans). One debt is for $10,000 at 12% and a second debt is for $20,000 at 10%. Together, your total monthly payment on both loans is $1,100 per month. A debt...

by yeseric | May 23, 2018

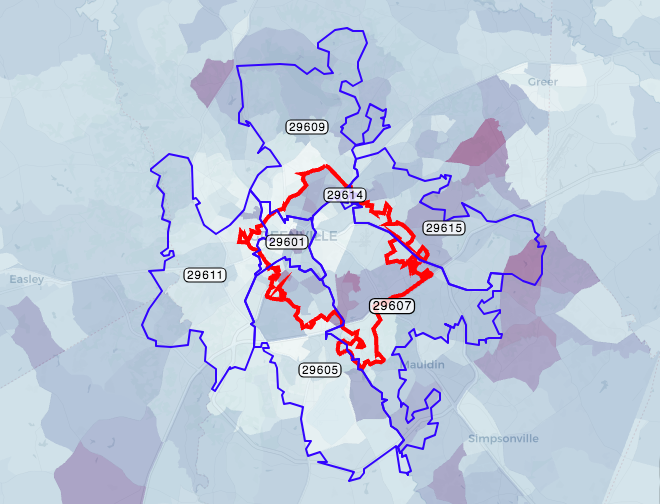

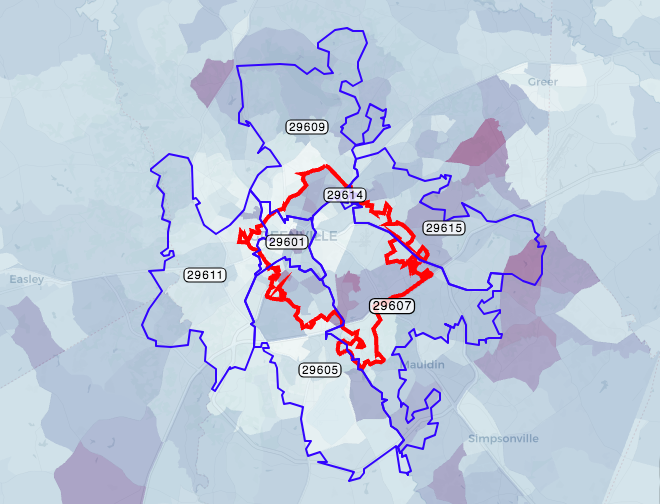

Within six zip codes in Greenville, SC (29601, 29607, 29615, 29609, 29605, 29611), African Americans and Latinos face a sobering student loan delinquency rate. These results come from Mapping Student Debt: How Borrowing For College Affects the Nation. My goal is to...