by yeseric | Aug 20, 2018

Just say, “No.” Delay purchases to get beyond the “heat of the moment.” Tell your kids that your whole family is on a budget. Stop eating out. Plan grocery trips. Use an envelope system. Buy your casual clothes at consignment stores. Make...

by yeseric | Aug 18, 2018

There is welcome news from investment firms like Vanguard and Fidelity: thousands of Exchange Traded Funds (ETFs) are commission free. Think of an ETF as a form of index fund. An ETF’s goal is to provide a return similar to the broader market at a minimal cost....

by yeseric | Aug 13, 2018

Happy people have consistent habits. They spend time with friends and family, practice gratitude, practice optimism, are physically active, and try to live in the present moment. Since money cannot buy happiness, why are we so obsessed with earning more money? If we...

by yeseric | Jul 23, 2018

Do you struggle to pay off your credit card each month? Do you max out your cards? Let’s review your credit card usage and ask 3 questions: How does my credit card usage affect my credit health? Each card account has a certain limit up to which a lender will...

by yeseric | Jun 21, 2018

You’re the one getting married, so here are a few tips to keep in mind as you plan your destination wedding: Be true to your desires. As others express their preferences, concerns, or cast doubt about your choices, stay focused on what expresses your...

by yeseric | May 25, 2018

Happy 230th birthday to the State of South Carolina! The Palmetto State became a state on May 23, 1788. There are countless legacies in the generations of South Carolinians who have come and gone. What will be your financial legacy? Say “I Love You” to...

by yeseric | May 23, 2018

Imagine you find yourself with $30,000 in unsecured debt (credit cards, student loans, and personal loans). One debt is for $10,000 at 12% and a second debt is for $20,000 at 10%. Together, your total monthly payment on both loans is $1,100 per month. A debt...

by yeseric | May 23, 2018

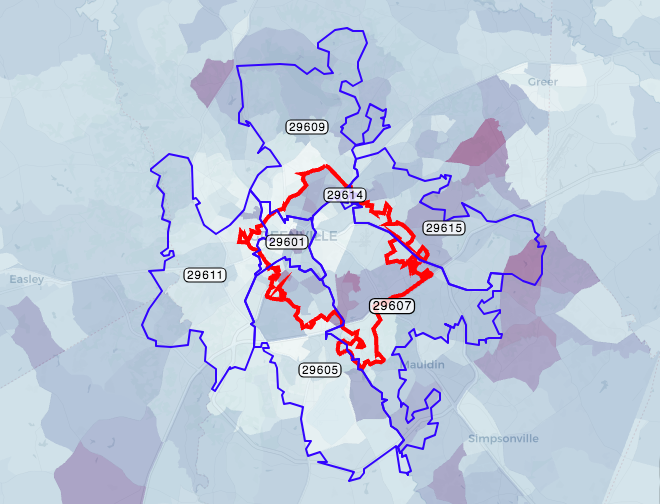

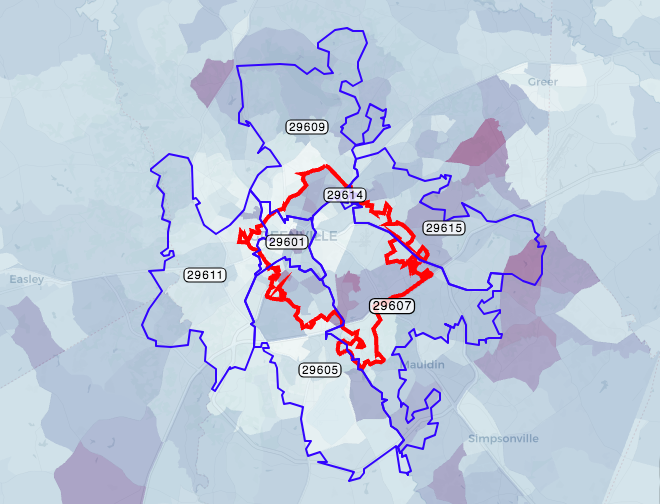

Within six zip codes in Greenville, SC (29601, 29607, 29615, 29609, 29605, 29611), African Americans and Latinos face a sobering student loan delinquency rate. These results come from Mapping Student Debt: How Borrowing For College Affects the Nation. My goal is to...