by yeseric | May 17, 2018

Meet Radar! He is very supportive of my financial coaching practice. He is also living proof that Greenville, SC has one of the best animal protection organizations in the country – the Greenville Humane Society. We adopted Radar a few years ago for only $50....

by yeseric | May 17, 2018

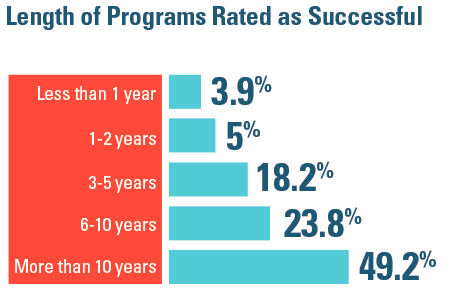

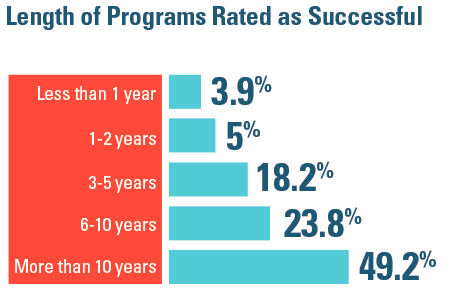

Are you an employer who is thinking about initiating a financial education program for your employees? If so, research from the International Foundation of Employee Benefit Plans (IFEBP) indicates that successful programs should remain in place for at least three...

by yeseric | May 11, 2018

If you are tempted to use your home equity to pay for everyday expenses like your child’s birthday party, don’t! The ad pictured above plays on your emotions while luring you into more debt. Be aware of ads like this one. Save up the $300 in advance....

by yeseric | May 10, 2018

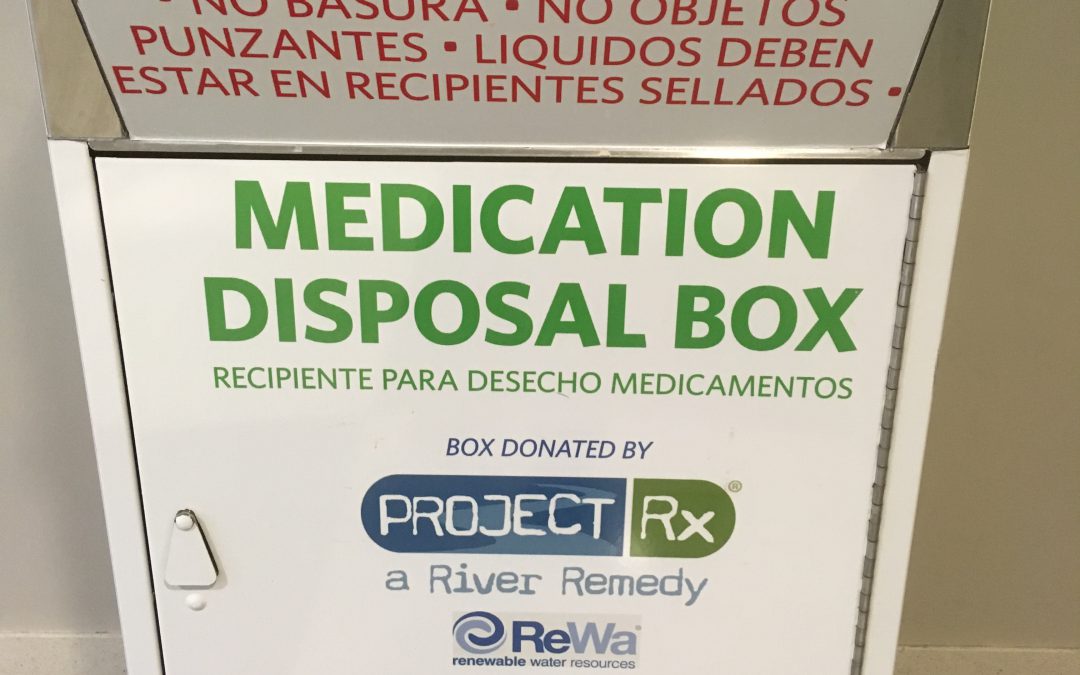

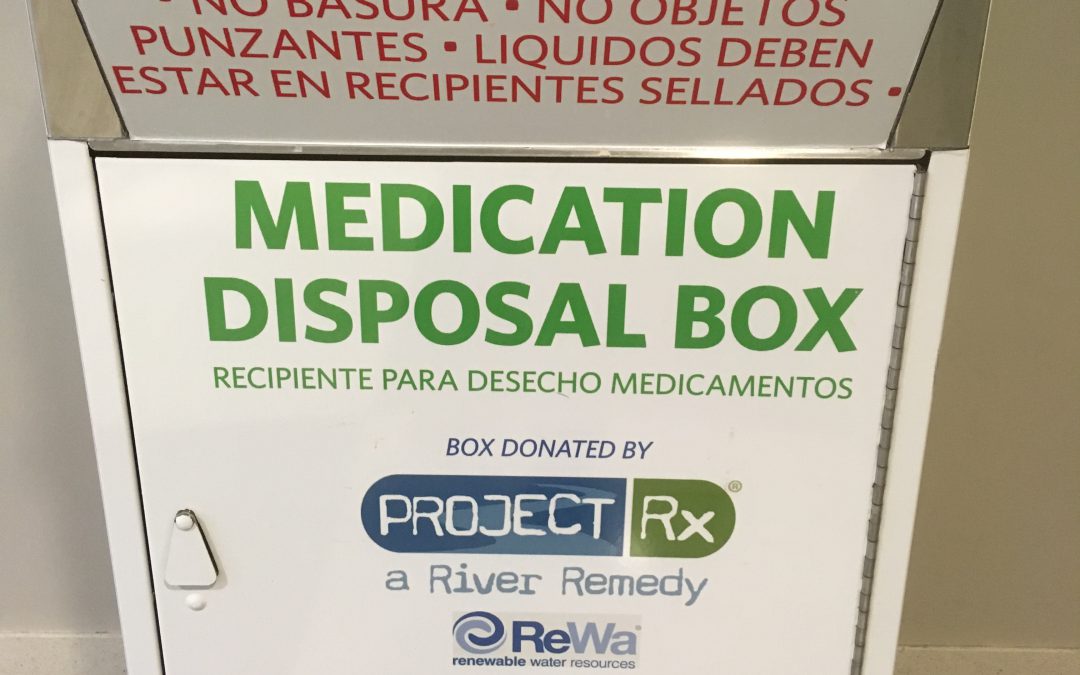

Living an organized life includes disposing of old medicines. Take advantage of no-cost drug disposal: Greenville, SC: The Greenville County Law Enforcement Center is located at 4 McGee St., Greenville or Upstate Pharmacy within Greenville Memorial Hospital, 701 Grove...

by yeseric | Apr 29, 2018

Thinking about financing a car and wondering how much you can afford? Never spend more than 20 percent of after-tax household income on ALL vehicles in your household. Let me provide an example: Let’s say your take-home pay of $25,000 per year (is $2,000...

by yeseric | Apr 29, 2018

Planning your financial future together is critical. Be open with your spouse about current debts. Talk with each other about financial goals for your next ten years together. Make it specific – buying a home, starting a family? Add up your combined income...

by yeseric | Apr 28, 2018

Amid the excitement of graduating from college, maintain two priorities: keep your student loan account in good standing and don’t miss any credit card payments. If you have neither loan nor credit card, then great! Unfortunately, current stats indicate that 44...

by yeseric | Apr 27, 2018

Do you want to explore attitudes toward money in your relationship, answer these ten questions with your significant other: We plan on keeping our finances separate. We haven’t decided how to handle our finances yet. We usually agree on how to spend money. I am...